What is a J-curve?

A J-curve is a trendline that shows an initial loss followed by dramatic gains. In a chart, this pattern of activity would follow a “J”. The J-curve is often used in economics to illustrate how a currency depreciation initially causes a severe worsening of trade imbalance followed by a substantial improvement. It is used in medicine and political science.

The J-curve in Private Equity: Understanding the Investment Lifecycle

In PE investing the J-curve is seen as an inevitable consequence of a company turnaround. It involves a period of increased losses followed by an upward swing. The J-curve effect is common in PE and is dependent on different factors but mainly comes down to 4 key reasons which are:

1. Management Costs

2. Investment Costs

3. Operational Fees

4. Immature Portfolio

This is why the curve starts to rise after the initial years since the portfolio starts to mature.

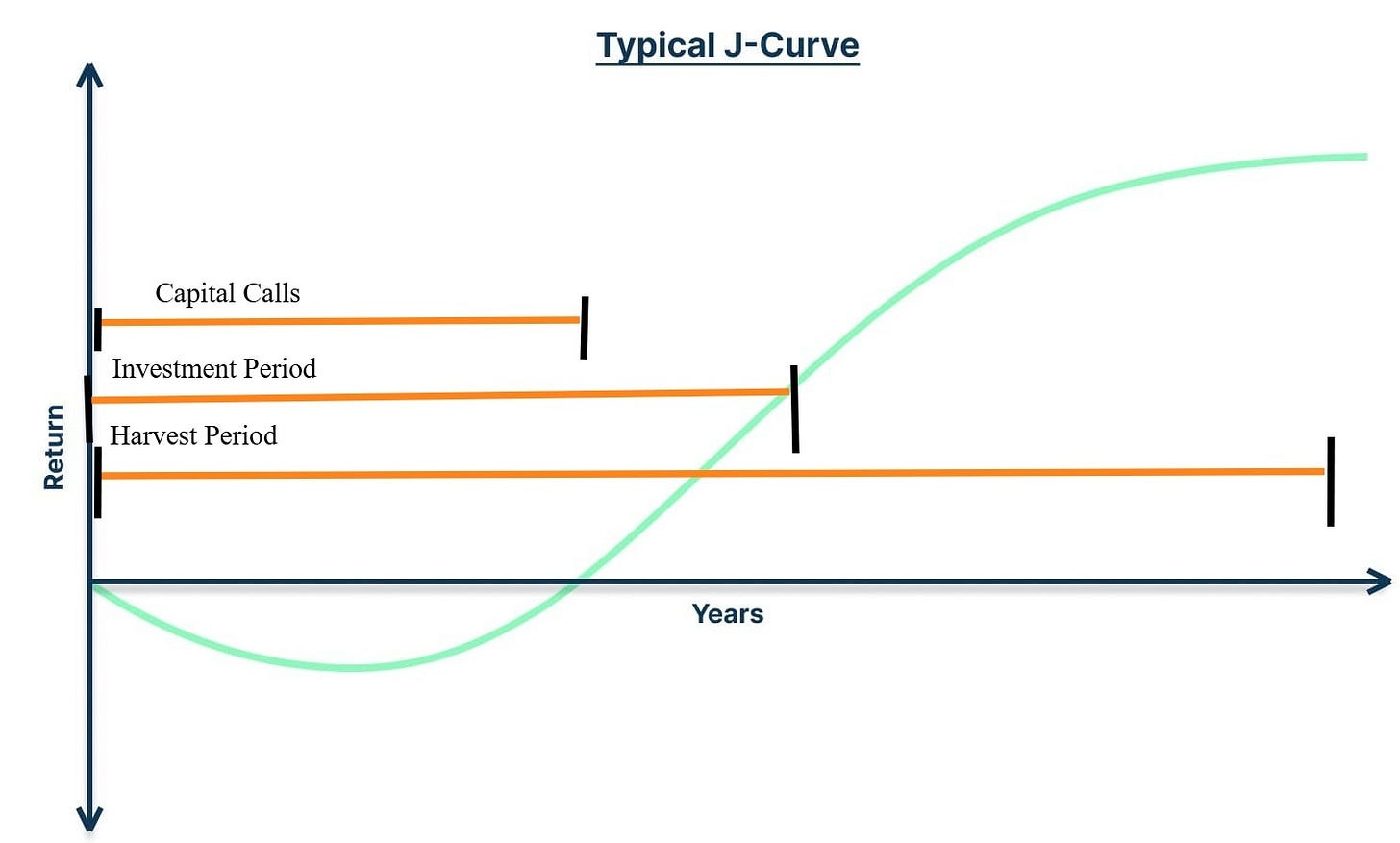

In PE investing, it is important to note that the fund managers have to come up with a business plan to leverage the company’s operations and make cash flow. The J-curve has mainly 3 phases:

1. Capital Calls: In the early stages of a PE fund, fund managers do not immediately invest all capital received from investors. Instead, they secure capital commitments which are drawn down as when the fund requires it to make investments. When capital is called in tranches the unused cash is not sitting idle. A natural feature of primary investments is the time lag between capital deployment and realization of returns. The PE Firm needs time to grow the revenue and operations of the portfolio company.

2. Investment Period: The fund manager starts to execute the value creation plan and the valuations associated with venture-backed companies, buyouts, Mergers and Acquisitions (M&A) and other PE investments. During this phase, investors start receiving returns as portfolio companies begin to mature, exit strategies are executed leading to a steeper J-curve.

3. Harvesting Period: The harvesting period usually begins at the 6th year of a PE fund’s lifecycle. As the manager, harvests the investments gains and distributes returns to investors, cash flow tends to flatten out and the fund’s performance flattens out indicating its end.

Strategies to beat the J-curve effect in Private Equity (PE)

Secondary Funds:

Secondary Funds involve the buying and selling of pre-existing Limited Partner’s (LPs) commitments. Instead of acquiring a stake in a newly formed fund, secondary investors acquire stakes in funds that are already in operation. This ensures that the LPs enter later in the investment cycle and closer to the period of value accretion. Secondary Funds shorten the outflow period and accelerate inflows. It offers quicker returns to the LPs. In PE(Primary Funds), there exists a “blind pool” risk. This means that the LPs do not know what investments the General Partners (GPs) are going to make. With secondaries, this risk is reduced because the LPs already know the investments made by the GPs.

Secondary Funds possess investment benefits due to the unique pricing dynamics of this space: discounts. This means that the purchase of a secondary interest at a discount of its Net Asset Value(NAV) will provide a mark-to market gain for the fund. The discount depends on variety of factors including the seller’s circumstances, quality of assets and sponsors and relevant market environment.

Secondary Funds possess risks as well. The valuation of such secondary interests is complex and valuation of assets can be challenging to determine. The value of the asset might differ from the actual amount paid. Secondary transactions will be subject to legal and regulatory challenges because these transaction involve getting approvals from GPs, LPs, Regulatory authorities and tax liabilities as well.

This could be solved by procuring M&A insurance. For example, in GP-led secondaries, the losses arising out of unintentional misrepresentation can be recovered by new investors from the insurer rather than the seller. This provides an extra layer of protection. This limits recourse against the seller-GP only to instances of fraud.

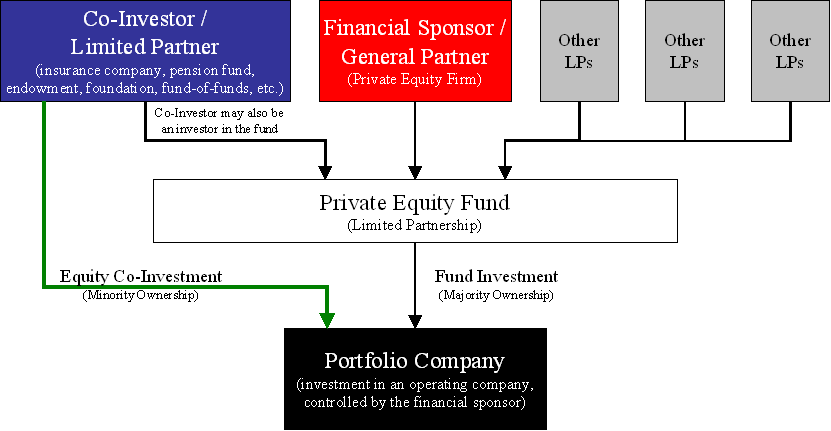

Co-Investments

Co-Investments are investments that are made alongside a PE Fund’s GP. Co-Investments accelerate capital deployment, as they lead to 100% of the committed capital being called. There are usually no fees or carry on such investments, making them cost-effective. This would reduce the length and depth of the PE fund’s J-curve by averaging down on fees and accelerating the deployment of capital.

3. Credit Facilities

The utilization of credit facilities will allow the PE Fund to secure capital against the LPs unfunded commitments. Instead of waiting for the capital calls of LPs, the fund can secure immediate financing through credit facilities. This would lead to quicker deployment of capital allowing the fund to access investment opportunities as and when they arise. One of the risks with this strategy is that it might lead to leveraging on the fund and during downturns it can magnify losses. Thus it is up to the fund managers to do a proper risk-return trade-off to optimize returns.

Performance Comparison

A comparison of the Internal Rate of Return (IRRs) of different PE strategies would highlight the impact of the J-curve mitigation. Secondary Funds possess a higher IRR due to quicker capital deployment, immediate valuation and the benefit of a discount as opposed to Primary Funds and Fund-of-Funds(FoF).

However, Primary Funds and FoF’s possess the potential to create value in the portfolio throughout the lifetime of an investment. As the portfolio companies continue to mature the IRRs of Primary Funds and FoF’s can increase significantly. By implementing these strategies, investors can mitigate the losses arising from the J-curve in the initial years of the PE Fund.

Conclusion

The J-curve is an inherent challenge in PE and reflects early-stage losses in PE investments. However, it can be mitigated by credit facilities, secondary funds and co-investments. These strategies will accelerate capital deployment and improve liquidity, thereby reducing losses. While these strategies optimize returns, risk management is crucial to maximize long-term value creation. By implementing these strategies, investors can beat the J-curve and drive high returns for long-term success.

Sources: Investopedia, Russell Investments, connectioncapital, moonfare, mercer investments, corporate finance institute.